Hello everyone!

Welcome to the 10th edition of the LAN. We’ve got a great range of articles, from discussing Germany’s new chancellor, to exploring the Greenpeace v Energy Transfer litigation.

Please enjoy and have a great rest of your week!

All the best,

Jago Cahill-Patten

Publications Officer

General Section

A New Era For Europe? German Chancellor-In-Waiting Calls for an End to Euro-American Co-Dependency

Elise Lunt

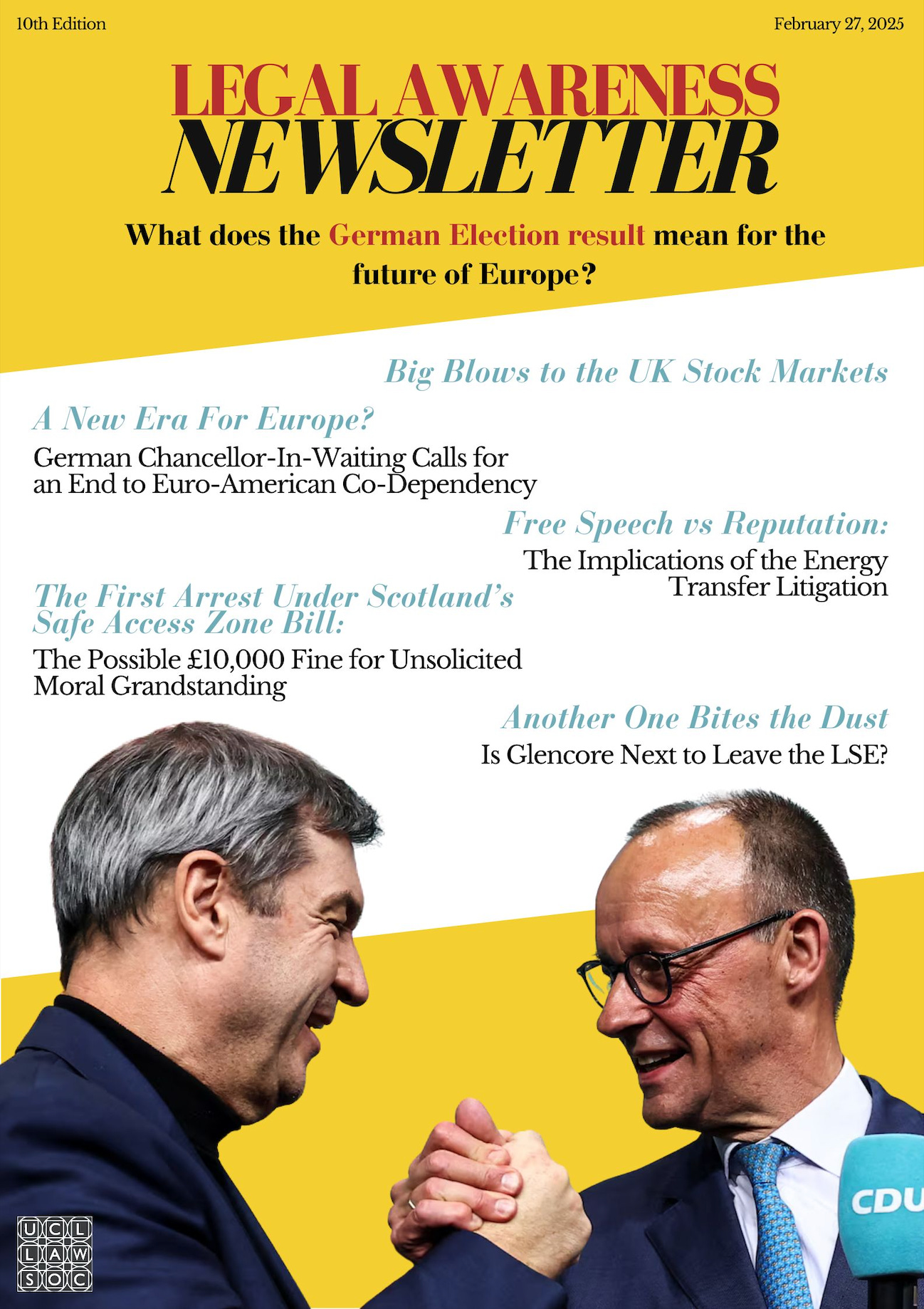

Germany’s chancellor-elect Friedrich Merz wasted no time waiting for the final election results before announcing a new era of transatlantic relations.

These sentiments are not unique, nor the first of their kind to emerge, since President Trump was re-elected to the White House, but coming from Merz, and so soon, they are significant. Despite Trump’s comment that the conservative’s win was a “great day for Germany and for the United States of America”, Merz remarked that the post-war alliance that Europe and the US have enjoyed for the past 80 years might be drawing to a close. He believes Trump to be “indifferent to the fate of Europe” and overlooking the continent to satisfy Moscow.

After it was clear his party, the CDU/CSU alliance, was the front-runner in the election, he did not hesitate to express his concern for the future of European foreign policy and international relations. He quickly warned the United States against making Europe an enemy, or, at least, losing their allyship. Further, he stressed the urgent need for the EU, and the continent at large, to establish “independent European defence [capabilities]”. This is even more pertinent considering the crisis currently facing NATO; its legitimacy in the current months will be under threat dependant on the next few developments regarding the war in Ukraine and any possible concessions accompanying peace negotiations.

As such, Merz is committed to ensuring Europe works toward ensuring its independence, defence-wise. He has stated he is “curious” as to whether Europe will still be “talking about NATO in its current form” by the time of the summit later this year, and whether European defence will need to drastically and urgently improved before then.

Discussions of bilaterial nuclear assurance agreements between Germany and other European countries have already started, particularly agreements with Britain and France. And considering potential undermining of NATO by the United States’, this seems pragmatic. Prime Minister Keir Starmer has already congratulated Merz on his win, stating that he welcomes this election as an opportunity to ‘enhance’ the ‘joint security’ of the two countries as well as delivering growth for both Germany and the UK. In addition to this, defence sources reportedly believe that the UK would come to Germany’s aid in the event of rapidly escalating tensions with Russia.

President Macron also congratulated the incoming chancellor, expressing that in this ‘period of uncertainty’, France and Germany would remain united. Note that Macron is scheduled to visit Washington D.C. on the Monday of writing this (24th February), exactly three years since the invasion of Ukraine. It is reported he will ask Trump for greater European involvement in any settlement made or peace talks taking place.

Merz now faces the challenge of putting together a viable and functional government. This process is expected to result in a coalition between the CDU/CSU and the SPD, the Sozialdemokratische Partei Deutschlands, and possibly the Greens. German mainstream parties have committed to exclude the AfD, Alternative für Deutschland, party, who came second in the election, from coalition talks. However, with pressure from figures such as Elon Musk and JD Vance, both of whom have announced their support for the far-right party, and the party’s undeniable electoral mandate, we may see more influence from the party in forming the next German government and, therefore, on the next four years of European politics.

The First Arrest Under Scotland’s Safe Access Zone Bill

Sam Schajer

Background

Last June the Scottish parliament passed the Abortion Services (Safe Access Zones) (Scotland) Act. This law was used for the first time to arrest a 74 year old woman in the first test of its effectiveness, proving that when it comes to breaking new ground, age is just a number.

What is the Law?

The Safe Access Zones law makes it illegal to protest or hold vigils within 200 meters of Scotland’s 30 abortion clinics. The law introduced two offences.

Offence of influencing, preventing access, or causing harassment in a safe access zone.

Offence of influencing, preventing access, or causing harassment in an area visible or audible from safe access zones.

There’s a fine line between free speech and forcing someone to engage with your views while they’re just trying to get to an appointment. It’s usually around 200 meters.

The rationale behind the law was to ensure that those who need access to these services can do so without interference or fear of harassment.

People who break the rules can be fined up to £10,000 or face an unlimited fine in serious cases. A steep price for the thrill of unsolicited moral grandstanding.

What did the lady do?

The lady arrested in this specific case was arrested after a protest she was part of gathered within the exclusion zone.

JD Vance’s Comment

JD Vance recently caused controversy with a comment about the new law in Scotland. He wrongly claimed that the law would stop people from praying in their homes if they lived near an abortion clinic. Vance’s claim that Scots are now forbidden from praying in their own homes is an interesting take, just not one based in reality. It does, however, raise serious concerns...mainly about his reading comprehension.

This claim was quickly shown to be incorrect, and Scottish politicians firmly sought to refute Vance.

Scottish politicians have raised fears that Vance’s factually wrong statement had emboldened protesters. Some may see the protests planned by a group of campaigns funded by Texas based group ‘40 Days for Life’, as evidence that this has already happened.

Will This Happen Across the UK?

The new law in Scotland is the first of its kind in the UK, but it’s started a conversation about whether other parts of the UK will follow suit. In England and Wales, there has been some support for introducing similar laws to stop protests near abortion clinics. But so far, no national law has been passed.

There is debate about whether a law like this is needed, and how to pass it in a way that respects freedom of protest, and women's right to access abortion services free of harassment.

Scotland's law has the benefit of acting as a trial run which will allow Westminster to evaluate the efficiency of the law and make a more informed decision about whether to pass similar legislation.

In short, the law in Scotland is already having an effect, with the first arrest showing its impact. While JD Vance’s comments were incorrect, they have sparked more debate about the law. Whether other parts of the UK will follow Scotland’s lead is still uncertain, but it’s a possibility worth watching.

What does the German Election result mean for the future of the Europe?

Oskar Puntmann

The European Union is at a crossroads in its existence. External threats to its structural integrity are cause for contention, while many of its constituents begin to question its ideals on which it was founded. Former Commission President Jacques Delors famously stated that “nobody can fall in love with the common market.” He was arguing the legitimacy of the EU depends on the willingness of its members to participate, thus having a conditional existence. Nevertheless, with the rise of Euroscepticism, especially in countries like Hungary, Austria and Italy, this existence appears in trouble. Germany, as the biggest country in Europe by population and GDP, has long been seen as the de-facto leader of Europe. Nevertheless, years of internal power struggle and economic stagnation have left it appearing absent. We now see a likely new German chancellor in Friedrich Merz.

Pan-European Relationships

In the wake of Trump’s election in the US, the future of NATO and European defence mechanisms appear uncertain. Nevertheless, Merz’s election may have positive effects on inter-European relations. He has signalled a wish for the to EU become independent from the US, especially in regard to defence, and appears more willing to collaborate with Germany’s neighbours, especially Poland and France, with whom his predecessor had a more strained relationship. Shaping these relationships will be crucial, as the Americans appear more ambivalent towards European security.

Migration

Migration may prove a contentious topic, especially in the context of EU law. It became one of the most important matters for voters in this election, especially in the wake of a number of recent attacks across the country. Merz wishes to reassert control over borders, with the proposals for constant controls at all German borders looking to be especially detrimental for the free movement of goods, workers and services. Germany is a crucial country for pan-European transit and trade. Enforcing strict border controls will slow trade, and may likely have an adverse impact on both the German and European economies.

The AfD

The Alternative für Deutschland, Germany’s far-right party made its biggest gains ever, doubling its vote share since the last election. This is down to many factors, from frustration with the ‘Volksparteien’, the traditional major German parties, who many feel let down by, to anger surrounding culture wars, for instance around migration, the LGBTQ+ community, and gendered language. While they are unlikely to form part of the government, they are nonetheless a force to be reckoned with. They have thus far struggled to find allies in Europe, with many writing them off for being too extreme, yet the legitimisation that this election brings may turn heads. This is especially if Merz collaborates with the AfD again, as he did in January, bringing down the 75-year-old political firewall.

It is hard to determine what the election will bring for the EU. It stands at one of the most volatile moments in its existence, while its biggest member has been asleep at the wheel recently. Germany remains distracted by many internal problems, and it is to be seen whether Merz will appear capable of handling the double burden of national and supranational responsibilities.

Big Blows to the UK Stock Markets

Max Currie

For a long time, the London Stock Exchange (LSE), has stood as one of the pillars of global trade and equity markets. However, in recent years the LSE has become more and more overshadowed by other foreign exchanges, leaving daunting questions about the future of the UK economy.

In 2024, 88 companies removed their listings from the LSE and are headed to more active and lucrative US-based exchanges or other European platforms such as Euronext, which has now reached nearly double the size of its UK counterpart. Some of the biggest names to withdraw from the LSE in 2024 include the travel and tourism company Tui, and the popular food delivery app Just Eat. A recently proposed withdrawal that has created further fear and stress amongst investors and other listed companies is the announcement by Glencore, the global mining and commodities giant, that it is undergoing an internal review to assess whether the company’s LSE listing should be ditched, in favour of moving to become listed on the New York Stock Exchange. As one of the largest constituents in the FTSE 100, the most famous group of high-value listed companies in the UK, Glencore’s departure would have a massive impact on the value of both the FTSE 100 and the wider LSE.

What does this mean for the UK?

For companies such as Glencore, the motivation is simple. They want their stocks to be traded on the best global exchanges, and the UK may be falling short of this. With the entirety of the FTSE 100 company list worth the same amount as just Apple or Microsoft alone, this mass departure from the London exchange may signal a huge downshift in the attractiveness of the UK markets. Furthermore, with the withdrawal of so many large companies in 2024, the most since 2009, it may become more difficult for the UK to attract large companies and foreign investment into the country, with large corporations undergoing a massive loss of trust and market confidence in the UK’s only stock exchange.

Looking forward

Despite the grim outlook the above paragraphs suggest, there is still hope for the LSE. With inflation coming down and the prospect of big names such as Shein moving into the exchange in 2025, there is still hope for renewed foreign interest in the LSE, especially with the projected growth in global M&A and IPO deals this year. In its 300-year history, the LSE had stood strong against the fiercest opposition, from the GFC in 2008 to the Covid-19 pandemic. A complete recovery back to its glory days may seem impossible, but with careful planning and regulatory support there is still hope for a revival of the LSE, a revival that in the minds of many is tied to the success of the UK economy and the labour government.

Commercial Section

LSE:

Short for ‘London Stock Exchange’. The LSE is the main and largest stock exchange of the UK, originating over 300 years ago. A stock exchange allows traders to buy and sell securities, including shares and bonds. Stock exchanges allow listed companies to raise capital and share ownership with shareholders. These exchanges facilitate economic efficiency through the fair allocation of capital, as individuals who would have otherwise saved their disposable income are able to invest it. The FTSE 100 is an index formed of 100 blue-chip (or reputable) stocks on the LSE and is often used as an indicator of the UK’s economic health. The more companies that list on the LSE, such as Shein’s planned IPO, the more the UK strengthens its position as a global financial hub, attracting both domestic and international investment. Post Brexit and a pandemic-induced slowdown, this is becoming increasingly important, with Finance Minister Reeves vowing to kick start economic growth. In an effort to boost the LSE’s attractiveness, the Private Intermittent Securities and Capital Exchange System is set to launch by May 2025, allowing institutional investors and high-net-worth individuals to trade shares in privately held companies.

Sharanya Trivedi

Another One Bites the Dust – Is Glencore Next to Leave the LSE?

Adrien Charles

Reports have emerged that Glencore is considering the option of moving its primary listing away from the London Stock Exchange (LSE). The potential switch is largely motivated by a search for deeper liquidity and stronger valuations, making the New York Stock Exchange (NYSE) the leading candidate for relocation. Should Glencore finally decide to take their primary listing elsewhere, it would add to the woes of the LSE, which is struggling with increasing exits from major companies.

Arguments for Moving Primary Listing

Glencore's entry onto the LSE in 2011 set a record as the bourse’s largest IPO at the time. Now among the FTSE 100’s top 15 companies by market cap, the Swiss-based firm is unquestionably a mainstay of the LSE. However, this status is now in jeopardy after a call Glencore CEO Gary Nagle had with reporters last Wednesday. He stated the company is evaluating whether London remains the best exchange for its primary listing.

In the same discussion, Nagle revealed the NYSE as the most tempting alternative to London. One of the main considerations behind this potential move is Glencore’s significant coal output. In 2023, the firm floated the idea of spinning off its combined coal operations into a new company listed on the NYSE, a move that would better align with the growing interest in fossil fuel investments in the US. The US has seen a shift in sentiment toward the sector, largely driven by the policies of President Donald Trump, who has emphasized that fossil fuels will play a key role in his vision for reshaping America’s energy landscape. This renewed focus on coal in the US has attracted the attention of US-based investors, who are increasingly keen on backing the sector.

More broadly, the US capital markets offer advantages that go beyond investor interest in specific industries. They provide access to much deeper pools of capital and a far more extensive investor base than London, particularly given that many US funds are limited in how much they can invest in companies listed outside the US. This restriction makes the NYSE an even more attractive option for companies like Glencore, seeking to tap into a broader and more lucrative market.

Implications for LSE

The London Stock Exchange faces significant challenges should Glencore depart. The bourse has been undermined by low valuations, a risk-averse pool of local investors and growing competition from other financial centres.

This potential exodus reflects a broader crisis of confidence in the UK market. The LSE has already lost substantial listings in recent years, including Cambridge-based chip designer ARM Holdings and gambling giant Flutter Entertainment. Each departure further erodes London's standing as a premier financial hub. The UK government and financial regulators have attempted reforms to make London more attractive, including relaxing listing rules and governance requirements. However, these efforts have yet to stem the tide of departures. A Glencore exit would signal that even these reforms are insufficient.

For remaining LSE-listed companies, Glencore's departure could likely accelerate the valuation gap between London and New York, potentially triggering a domino effect. Mining firms are particularly vulnerable, as evidenced by BHP's consolidation in Australia and Rio Tinto facing activist pressure to abandon its London listing.

SLAPPs:

Short for ‘strategic lawsuits against public participation’. These are lawsuits intended to censor opposition by burdening them with legal fees associated with the cost of a defence until they are unable to continue. The claimant in a SLAPP does not usually expect to win, but rather to dissuade the defendant from continuing with the litigation and as a result abandoning the criticism. Examples of past SLAPPs include a 2021 libel action against HarperCollins which left journalist Catherine Belton with £1.5m in legal costs. The Hulk Hogan v Gawker lawsuit in 2016 sent shockwaves through the journalism industry, as it was revealed that Hogan’s $140m lawsuit against Gawker Media was funded by Peter Thiel, as retaliation for the media outlet outing him as homosexual. In response, some US states strengthened anti-SLAPP laws and increased scrutiny of litigation funders. In an effort to tackle this discriminatory litigation strategy, the EU introduced the anti-SLAPP Directive in April of last year. The anti-SLAPP Directive allows for member states to dismiss claims deemed to be without merit, require the claimant to bear all legal costs, or provide additional support to SLAPP victims. Energy Transfer’s continued lawsuits against Greenpeace are an example of relentless SLAPPs.

Sharanya Trivedi

Free Speech vs Reputation: The Implications of the Energy Transfer Litigation

Iman Khalil

Striking the correct balance between protecting freedom of expression and safeguarding reputation has always been a difficult task, and the current Greenpeace v Energy Transfer lawsuit demonstrates this tension exists as much the case in the corporate realm as it does in the civil.

The Lawsuit's Origins and Allegations

In February 2025, Energy Transfer, a prominent fossil fuel corporation, initiated a $300 million lawsuit against Greenpeace USA, alleging that the environmental organisation defamed the company and incited criminal activities during the 2016 Dakota Access Pipeline protests. The Dakota Access Pipeline, constructed by Energy Transfer, faced substantial opposition from Indigenous tribes and environmental groups in 2016. Protesters expressed outrage over the potential environmental hazards and desecration of sacred lands resulting from their activities. Energy Transfer's lawsuit contends that Greenpeace disseminated false information and incited unlawful acts, leading to financial and reputational harm to their company. Greenpeace, however, maintains that its actions were within the bounds of lawful protest and free speech, and denies orchestrating violent activity.

Strategic Lawsuits Against Public Participation (SLAPPs)

Legal experts and activists have criticised Energy Transfer's lawsuit as a Strategic Lawsuit Against Public Participation (SLAPP). SLAPPs are legal actions intended to censor, intimidate, and silence critics by burdening them with the cost of a legal defence until they abandon their criticism or opposition. This tactic is increasingly employed by corporations to deter activism and suppress dissenting voices. The Energy Transfer case exemplifies how powerful entities might use the legal system to stifle environmental advocacy and free speech. Under the Sunak government a Strategic Litigation Against Public Participation Bill was proposed, with the intention of legally prohibiting SLAPPS but it failed to garner significant support, thus leaving the issue unresolved.

Implications for Corporate Litigation Strategies

The outcome of this lawsuit could set a precedent for corporate litigation strategies against NGOs and activists. A ruling in favour of Energy Transfer may embolden other corporations to adopt similar legal tactics to suppress opposition, potentially leading to a chilling effect on environmental activism and public protest. Conversely, a decision favouring Greenpeace could reinforce protections for free speech and the right to protest, discouraging the use of SLAPPs as a tool for corporate retaliation.

Greenpeace's Counteraction and the Role of Anti-SLAPP Measures

In response to the lawsuit, Greenpeace International has filed an anti-intimidation case against Energy Transfer in The Hague, Netherlands. This legal move leverages a new EU directive designed to counter SLAPPs, aiming to protect civil society organisations from unfounded lawsuits intended to harass and silence them. Greenpeace is seeking compensation for legal fees and damages and aims to have the proceedings declared a SLAPP. This countersuit not only challenges Energy Transfer's claims but also tests the effectiveness of international legal frameworks in safeguarding activist organisations from corporate legal intimidation.

Broader Context and Future Considerations

The Energy Transfer versus Greenpeace case is emblematic of a broader trend where corporations utilise legal avenues to suppress environmental and social justice activism. This strategy raises concerns about the balance between protecting corporate interests and upholding fundamental rights to free speech and protest. As these legal battles unfold, they will likely influence how NGOs operate and how corporations formulate their litigation strategies against dissenting voices.

The lawsuit filed by Energy Transfer against Greenpeace serves as a critical juncture in the intersection of corporate power, legal strategy, and activist rights. The legal community, policymakers, and activists worldwide are closely monitoring this case, recognising its potential to reshape the landscape of environmental advocacy and corporate accountability.