Hello everyone! Welcome to the 4th Edition of the LAN. We have a lot of interesting articles in this edition, with a real focus on politics. If you want to learn about the new Conservative leader Kemi Badenoch; Trump’s White House aspirations; and Kier Starmer’s new government, then read on.

As usual, we have 6 articles, including 2 in our commercial section.

Please do enjoy!

All the best,

Jago Cahil-Patten

Publications Officer

General Section

Great British Energy, is it the spark the UK needs?

Max Currie

With the not-so-recent shift to a Labour government, the UK’s renewable energy future may be looking up. In June, the new government announced the creation of a national clean energy investment and generation body, with the aim of funding small and medium-sized renewable energy projects around the country. GB Energy, with £8.3 billion in allocated funding, will develop clean energy technology such as offshore wind and green hydrogen, collaborating with the private sector to get these projects off the ground. The proposal is promising, but its announcement has already been marred with scepticisms that need to be addressed.

The Positives

GB Energy offers benefits for two key stakeholders, the consumer and the climate. For UK households, cutting energy bills is still a top priority. With GB Energy, the government has set an objective of cutting electricity bills by up to £300 per year for every household in the country. With the national electricity and gas price cap increasing by 10% in October and a further 3% next year, this is a welcome target for families. The company will also bring about the creation of secure jobs in the energy sector, with the future projects projected to provide 650,000 new jobs.

GB Energy also represents a concrete step towards reducing the UK’s greenhouse gas emissions. With the UK already predicted to fall short of its 2050 net zero target, a strong investment body and economic plan for the construction of renewable energy projects is a massive step towards real climate action. The UK is going to need over £900 billion in investment to achieve its net zero target, so whilst the £8.3bn is just a drop in the ocean, the potential for additional private capital could help to meet this far off target.

The Hiccups

There are also two crucial roadblocks to GB Energy’s success. Firstly, the promise of private investors coming into the clean energy industry, under this new investment company, may be harder to achieve than it sounds. The government wants to attract over £60 billion in private investment to facilitate its clean energy targets, but unless it can work closely with the UK’s largest energy developers and investment companies and show guaranteed returns, this hefty sum may be difficult to reach. Secondly, the tight restrictions within Labour’s budget will limit GB Energy’s flexibility and investment powers. With much needed extra funding for the NHS, education and other public services, the budget has little leeway for GB Energy, and the body will not be permitted to borrow money to prevent accumulating interest payments on the already-strained budget. Some experts condemn this as a significant oversight, with debt finance an effective and very necessary way to raise clean energy funding.

Looking forward

With ambitious planning and private sector collaboration, GB Energy will hopefully overcome these challenges and secure funding for the transformation of the UK’s energy supply and bring about substantial benefits for the UK and the global climate. It remains to be seen whether the government has the flexibility and dedication to overcome GB Energy’s hurdles, but to combat the climate crisis we must be positive and see this initiative as the spark that the energy industry needs.

Kemi Badenoch: Who is she and what does her leadership mean?

Lucas Connor

The Conservative Party’s tumultuous leadership journey has taken a new turn in the past few weeks with the election of Kemi Badenoch as party leader. Having successfully defeated second-place challenger Robert Jenrick, her election marks the first time a Black person has led a major British political party. Badenoch faces a momentous struggle ahead of her as she aims to repair her party’s image after a catastrophic 2024 election performance. Doing so will require her to fend off traditional opposition from Labour as well as from the novel right-wing Reform Party. But just who exactly is Badenoch and how will she achieve this?

Having first entered Parliament in 2017, she has made a name for herself by steadily rising within the ranks of the Conservative Party. In February 2020, she was first appointed as Minister of State for Equalities in Boris Johnson’s government. In July of 2022, she shot into the spotlight during her first Tory leadership run by making it to the fourth round of voting. It was here that she established herself as a member of her party’s right-wing, openly criticising proposals to reach net-zero emissions as well as bashing the propagation of so-called “critical race theory”. She continued her career in the Cabinet of fellow Thatcherite Liz Truss as Secretary of State for International Trade, a position she retained in Rishi Sunak’s government. After two years in his government and the collapse of Conservative rule, Badenoch launched her second and ultimately successful leadership challenge.

Notable about this race was that both front-runners, contrary to recent political history, have come from the party’s right-wing, marking a notable shift in its trajectory. Badenoch has sought to maintain this reputation of herself, openly criticising the supposed ‘apologetic’ nature of her party. She has called to make the Conservatives more assertive and not have them shy away from ‘cancel culture’. This framing is in large part reflective of the public view of the Conservatives, something which inextricably contributed to Reform’s massive 14.3% surge in the vote share.

For Badenoch, claiming back these disgruntled ex-Tory voters is a must if she is to carry her party back to electoral victory. She has surrounded herself with like-minded individuals by bringing Priti Patel into her Shadow Cabinet and openly praising figures such as Elon Musk and Donald Trump. Additionally, her election pamphlet, entitled “Conservatism in Crisis: Rise of the Bureaucratic Class”, lays out a provisional plan of how she will amend the woes of the British state. Here, she calls out a nexus of political interest groups and supposedly liberal administrators that have, for her, overseen the political and economic decline of Britain. Consequently, a Badenoch Prime Ministership would likely entail significant deregulation across all aspects of the civil service. She already oversaw a similar approach as Secretary of State for Business and Trade where she spearheaded the passage of the 2023 Retained EU Law Act in which over 800 remaining laws from the EU were removed. Additionally, she has vowed to crack down on ‘free speech boundaries’, possibly hinting at amendments to the 2003 Communications Act which currently regulates hate speech in Britain.

However, her stances are not fully embraced by those within her party. During the leadership election, the centrist Tory Reform Group drew significant support in refusing to endorse either Badenoch or Jenrick. After all, it was Labour, not Reform, that won the election. For Badenoch, a lurch to the right is needed to rejuvenate the Conservative Party. Whether this succeeds is yet to be seen.

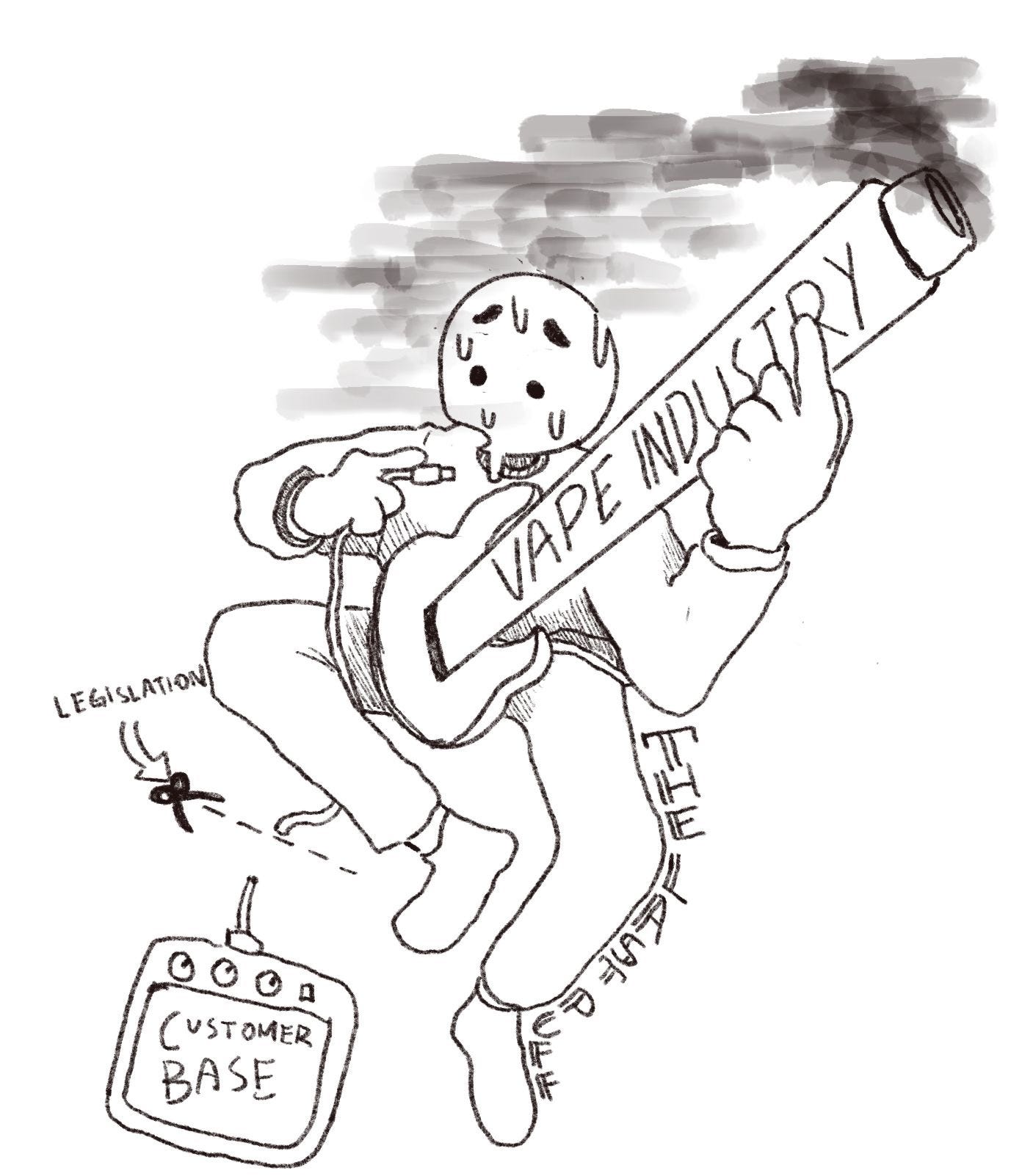

The Last Puff: UK’s crackdown on Smoking and Vaping

Davon Pung

The Tobacco and Vapes Bill, introduced in Parliament on 5 November 2024, is a landmark proposal focused on protecting children, the environment and the most vulnerable in our communities. The Bill sets out to create the world’s first smoke-free generation.

Interestingly, this is not the world’s first attempt at such a radical measure. In 2022, New Zealand enacted legislation instituting a smoking ban for future generations. However, less than a year later, their new government quashed it on the basis that revenue from cigarette sales would enable the coalition’s tax cuts. Nor is this the first time this has been attempted in the UK, with a bill of the same name also proposed under former Prime Minister Rishi Sunak

While there are numerous compelling reasons for the ban, we will begin by addressing one of the most common arguments raised by dissenters: that society, counterintuitively, benefits from the tax revenue generated by cigarette sales. The unfortunate reality is that the true cost of smoking vastly outweighs any potential tax revenue. The Department of Health and Social Care (DHSC) published that smoking claims around 80,000 lives annually in the UK, placing immense pressure on our NHS and costing taxpayers £3.1 billion a year. When considering broader economic impacts, the gross cost of smoking to public finances soars to £20.6bn.

Ultimately, this is a move that echoes the government’s reform agenda to shift the focus of healthcare from sickness to prevention and aligns with its smoke-free 2030 ambitions - defined by adult smoking prevalence falling to 5% or less.

What’s snuffed out?

The new legislation will ban children born after 1 January 2009 from ever being able to legally smoke by implementing a ban that will raise the legal age of sale of cigarettes by one year, every year until it is eventually illegal for the whole population. This policy is planned to come into force in 2027 when current 15-year-olds turn 18.

The Bill also grants the government new powers to restrict vape flavours, packaging and in-store displays, as well as imposing an outright ban on vape advertising and sponsorship. This is all aimed at reducing the appeal and visibility of the products, to deter marketing towards children. Complementing this, new environmental protection legislation will outlaw the sale of single-use disposable vapes starting 1 June 2025, in England, Wales and Scotland, as confirmed by Circular Economy Minister Mary Creagh.

Separately, Chancellor Rachel Reeves’ budget includes a new tax on vapes which coincides with an equivalent increase in tobacco duty to "maintain the financial incentive to switch from tobacco to vaping.”

Is this an attack on personal autonomy?

The DHSC emphasised that the new laws do not encroach on freedom of choice and will not impact smokers’ current access to tobacco products. The Bill does not seek to criminalise smokers; rather, it allows retailers to continue selling cigarettes and other tobacco products while gradually phasing out smoking among younger generations.

While industry leaders have asserted that “a knee-jerk reaction of a ban will help the black market to thrive”, historical evidence suggests otherwise. For instance, illicit cigarette consumption fell by 25% when the smoking age was raised from 16 to 18, showing that targeted tobacco control measures can positively impact contraband tobacco issues.

Third time’s the charm

The Tobacco and Vapes Bill is pioneering legislation that positions the UK among countries with the strictest anti-smoking policies, alongside Mexico, Portugal and Canada. This newest attempt, boasting a comprehensive, multi-pronged approach, may indeed breathe new life into public health policy, setting a standard for the global community to follow suit.

Unite to Begin Judicial Review Proceedings on Labour Winter Fuel Payment Cuts

Walter Cheung

Trade union Unite the Union (otherwise known as Unite) has launched a judicial review to challenge the UK government’s decision to tighten eligibility criteria for Winter Fuel Payments.

Background

First introduced in 1997, the Winter Fuel Payments are state benefits of £200 or £300 given to English and Welsh pensioners every year to cover for their winter heating bills. The payment was initially a universal benefit for everyone above the State Pension Age. However, from this year onwards, only households with Pension Credit or other means-tested benefits would be eligible for the payment benefits. According to an estimate by the Department for Work and Pensions, 1.5 million individuals in 1.3 million households will be eligible for the payments after this change. This greatly contrasts with payments in previous years, when around 11.6 million individuals in 8 million households were eligible in winter 2023-24.

The change was first coined by Chancellor of the Exchequer Rachel Reeves on 29th July as part of Labour’s plan to address a ‘£22 billion black hole in public finances’ from the previous Conservative Government’s spending. The Government expects the cut to save £1.4 billion in its 2024-25 budget.

The judicial review and other instances of opposition

The grounds for Unite’s judicial review can be encapsulated with two main issues: 1) the Government had failed its legal duty to assess considerable evidence on the cut’s impact and refer it to the Social Security Advisory Committee, and 2) the decision’s harms to vulnerable groups such as the elderly and disabled were not accounted for, breaching the Human Rights Act 1998 and Equality Act 2010.

In its council model motion, Unite emphasizes the financial burden this poses on low-income households in light of rising energy prices. Additionally, it raises the possibility that the number of excess winter deaths caused by living in cold homes could increase. To highlight the decision’s harms, Unite intends on bringing up several low-income members on retirement who will no longer be eligible for payment as ‘test cases.’

Aside from Unite’s judicial review, unions won a non-binding vote opposing the cut at the Labour Party Conference on 25th September. Charity Age UK has also voiced disagreement with the decision, stressing the lack of compensatory measures to those most affected by the cut. Moreover, signatories are accumulating for the ‘Reverse changes to Winter Fuel Payment’ petition on Parliament’s Petitions website (see here), calling for the Government to revoke the payment cuts.

Wider Implications

Most rhetoric employed by Labour politicians spearheading the change, points toward a long-termist approach to public spending. Most notably, Prime Minister Keir Starmer acknowledges the decision being “unpopular” and “tough”, but “necessary… to stabilize the economy.” Reeves has also admitted to the cut being a “difficult decision” to correct spending. That said, it is unclear if remedial measures are in order to mitigate the short-term harms to low-income households. The decision could also suggest a trend for the Starmer administration to shift towards a more ‘right-wing’ position, with the cut being likened to the previous Governments’ austerity measures in the 2010s.

Furthermore, the decision has received little prior scrutiny. In particular, the cut was not previously listed as part of Labour’s manifesto and documented agendas, making it seem abrupt and unprecedented. While this could be attributed to the urgency of the plan in light of decreasing temperatures, it might be indicative of the Government being willing to take swifter action to address long-run objectives.

Given that winter is approaching very soon, calls for revoking the decision are likely to hear quick responses. Unite anticipates ‘a fairly rapid hearing of the case’, which can be expected to commence this or next week.

Commercial Awareness Section

Capital gains tax (CGT):

A tax imposed on the sale of an asset based on its value. The tax is not levied on the value received for the sale but rather the gain made as a result. For example, this can include the sale of shares. If 100 shares were bought for £5 per share, but then sold for £8 per share, the value taxed would be £300 as that would be the gain made on the transaction. Like any other type of tax, like direct income tax or VAT (value-added tax), the revenue from CGT helps fund public services and can aid in government campaigns for income redistribution. In the UK, there is no distinction between short-term and long-term capital gain. In countries like the US, where short-term CGT rates are usually higher, the relevant financial authority tries to avoid market speculation by disincentivising the quick buying and selling of shares, which may lead to a volatile market. As of the 2024 budget, the new UK CGT system involves a uniform CGT framework with distinctions for basic rate and higher rate taxpayers depending on income. The Annual Exempt Amount, which is a tax-free allowance allowing a certain amount of profit before CGT is applicable, has been reduced significantly. Law firms will now attempt to advise businesses and private clients on how to comply with these new CGT regulations. Many law firms have released insight notes on the impacts of the Autumn budgets, as their clients race to understand these new provisions.

Sharanya Trivedi

The Controversial UK Budget 2024 - A Step Backwards for the UK Economy?

Muyiwa Oladokun

“A difficult choice made to raise the revenue required to fund our public services” and an attempt to “restore economic stability.” These were the words of Chancellor Rachel Reeves when describing her Autumn Budget of 2024. However, this hasn’t stopped much criticism, due to its potentially negative impact on the UK economy and commercial sector.

A ‘Budget’ simply refers to an annual statement made by the Chancellor, setting out the Government’s plans for the economy. This may include changes to taxation policy and Government spending - decisions made with the ultimate goal of attaining economic growth.

So what did the Government’s recent Budget Involve?

The main point of contention regarding the Labour Government’s budget is certainly their audacious decision to increase taxes by £40bn. With the budget raising taxes to their highest level in 70 years, the £40bn involves a staggering £25bn increase in national insurance contributions (NIC) from employers. Interestingly, the £40bn raise also includes a substantial increase in capital gains tax from 10%-18% and 20%-24%, coupled with a 20% VAT on private schools. What’s equally important is the Chancellor’s decision to borrow an extra £28bn a year, as well as a large emphasis on increasing government spending to enhance the quality of public services like the NHS and TfL.

Nonetheless, Chancellor Rachel Reeves has stated that the decision to increase taxes was made to amend the £20bn financial ‘black hole’ caused by the previous Conservative government, and to “rebuild” our public services and economy.

How Might the Budget Impact the Economy?

Conversely, though, many have pointed out the challenges that the budget poses on UK businesses and therefore the economy. While the budget definitely seems to benefit working people, given the increases in minimum wage, the historic raises in NIC and Capital tax gains may stifle business growth, which could make investments into such businesses a less attractive option. This decreased investment could damage the economy.

In fact, even the increase in national minimum wage has been criticised due to its impact on small businesses. Gareth Morgan, CEO of Balance, pointed out that the increase in minimum wage would “push away” small businesses instead of “encouraging them.” It therefore seems the budget may negatively impact the profitability of UK businesses both small and large, and crucially, this could slow down economic growth by decreasing investments.

How Might the Budget Impact Commercial Law Firms and Their Clients?

As we know, the budget’s drastic increases in capital gains taxes are believed to stifle business profits and this could negatively impact commercial law firms. Why? These tax increases mean that businesses will have less capital available to launch new M&A deals and private equity investments. This would decrease the demand for legal services in these areas, meaning law firms may make less revenue. Interestingly, though, it would be equally valid to argue that the raises in tax on businesses may increase the demand for Restructuring services from law firms. All this means is that UK businesses may seek for more legal advice from law firms on how to cope with the financial difficulty caused by the budget. This could be a viable source of revenue for law firms going forward.

For now, the consensus seems to be that the budget may be a momentary step backwards for our economy. It will nonetheless be fascinating to see how commercial law firms grapple with these changes.

Tariffs:

A tax on imports or exports from or to other countries by the government of a country or an intergovernmental/supranational union. While in general, free trade is encouraged to boost competition and therefore innovation between states, tariffs can be used for a variety of reasons. Australia, for example, has stringent food and beverage regulations because of their vulnerability as an island nation, so they tend to limit certain risk-prone items. More commonly, however, tariffs are used as political leverage, a way of exerting influence over a trading partner to achieve a political goal. Since 2018, the US and China have been engaged in a trade war, involving varying tariffs and quotas depending on the political climate between the two nations. India, for example, uses tariffs to protect itself as opposed to as a political weapon, setting tariffs on electronic goods from East Asia to boost its own local electronic manufacturing market. After Brexit, law firms, including Freshfields, advised several MNCs on UK-EU trade relations and resulting tariffs from the EU-UK Trade and Cooperation Agreement. With the recent US election and Trump’s Chinese foreign policy, law firms will likely be assisting clients with new China trade barriers.

Sharanya Trivedi

Trump’s Return to the White House: Rewiring U.S. Trade Policies and the Global Economic Web

Simone Liang

In a surprising turn of political fate, Donald Trump’s re-election has reignited debates on the direction of U.S. trade policy. With his return, major economies from China to the EU are bracing for potential recalibrations in tariffs, trade agreements, and investment regulations. Trump’s original trade doctrine was unapologetically protectionist, focused on “America First” policies. This upcoming term could amplify those stances, and global businesses must grapple with a delicate balance of challenges and opportunities.

Tariffs and Trade Policies: The Strategic Implications of Protectionism

Trump’s re-election could reignite his trademark reliance on tariffs as a central instrument of trade policy. These tariffs were designed not only to pressure foreign governments but also to shift production back to American soil, thereby reducing U.S. dependence on foreign manufacturing. If Trump moves forward with a similar, or even intensified, strategy, we can expect U.S. industries to face higher input costs and supply chain constraints due to the barriers placed on cheaper imports. However, such a policy shift could ultimately create incentives for investment in domestic industries, particularly in sectors like technology, pharmaceuticals, and advanced manufacturing.

For China, an increase in tariffs would signal a renewal of trade tensions that may force it to bolster its trade relationships elsewhere. With an economy that has grown more resilient over recent years, China is likely prepared to continue diversifying its trade partners, strengthening its ties with Asia-Pacific and African nations, and investing in global initiatives like the Belt and Road. These actions may accelerate the gradual decoupling between the U.S. and Chinese economies, leading to a world where economic power increasingly aligns along regional lines, with the U.S. and China each influencing their own trade spheres.

European economies may also brace for renewed friction. During Trump’s previous administration, the EU faced the possibility of tariffs on luxury goods, automobiles, and other high-value exports. A return to such policies would encourage the EU to pursue greater independence in trade policy, emphasising resilience by reducing reliance on U.S. trade. This could also push the EU to speed up negotiations on trade agreements with other regions, such as Asia, Africa, and Latin America. This would be a means of diversifying its trade dependencies and insulating itself from future U.S. imposed trade restrictions.

Implications for Emerging Markets: Between Pressure and Opportunity

For developing economies, Trump’s return may open doors as well as create unique challenges. Emerging markets, particularly in Southeast Asia and Latin America, have been positioning themselves as alternative manufacturing hubs—a trend that Trump’s policies could accelerate. If the U.S. imposes renewed tariffs on China, American companies may increasingly look to these regions for cost-effective production. Countries like Vietnam, Malaysia, and Mexico could see significant growth in foreign direct investment as companies diversify away from China.

However, this opportunity is balanced by the complexity of maintaining consistent trade relations with a U.S. administration that has demonstrated a willingness to unilaterally impose tariffs on trading partners. Developing markets might see short-term gains in investment, but they must prepare for a long-term environment that requires agility and resilience. This is pertinent as they face pressures to integrate more sophisticated production capabilities to compete with China’s advanced manufacturing sectors.

In this environment, regional agreements and economic alliances among emerging markets could become vital. Southeast Asian countries may deepen cooperation within ASEAN to bolster intra-regional trade, enhancing their collective appeal as a unified economic bloc that can attract U.S. and European investment. Likewise, Latin American countries, underpinned by the USMCA framework, could work to solidify North-South trade ties. However, each of these economies will need to consider the potential volatility associated with relying on U.S. trade policy, which could change direction depending on future elections or political shifts.

Conclusion: Navigating an Era of Trade Volatility and Strategic Repositioning

As Trump reassumes office, the business landscape must be ready for a period of strategic recalibration. Protectionist policies are likely to be central to Trump’s agenda, potentially creating significant shifts in trade and investment flows. For U.S. businesses, the coming years will demand a focus on supply chain resilience, diversification of partners, and a re-evaluation of global sourcing. Meanwhile, global players must prepare for a landscape increasingly shaped by regional alliances and economic spheres of influence, each positioning itself to navigate and even benefit from the volatility that may characterise U.S. trade policy.

Links:

German Coalition Collapses:

After Finance Minister Christian Linder was fired by Chancellor Olaf Scholz, Europe’s strongest economy is facing immense political uncertainty. The already-shaky coalition is expected to face a no-confidence motion early next year, kickstarting a parliamentary election in 2025. This was triggered by an intense disagreement over the 2025 budget amidst negligible economic growth.

Elon Musk Has a Lot to Gain from Trump’s Presidency:

Musk injected at least $130m into Trump’s campaign, even campaigning in-person in swing states. While billionaires often endorse presidential candidates from behind the scenes, Musk’s visible role is unique, potentially pre-empting his role in policymaking under Trump’s wing.

China’s Mammoth Economic Package:

China’s new fiscal plan includes $1.4 trillion to help provincial and city-level governments boost local economies. Particularly after Trump’s victory, China is bracing itself for increasing trade tensions and a slowing real estate market. Financial advisors warn of inflationary pressure.

Sanctions Sink Russia’s Gas Project:

After exporting record oil volumes, despite EU sanctions, Russia had hoped that their new export facility, Arctic LNG 2 would continue to support expansion. However, Western nations are restricting shipping routes to stop liquefaction of natural gas.